A cyber threat actor with the alias “infamous” has recently disclosed a data breach impacting Liberty General Insurance in India, involving the unauthorized access and potential sale of extensive personal data of roughly 152,000 individuals.

Figure 1:The thread posted by the threat actor

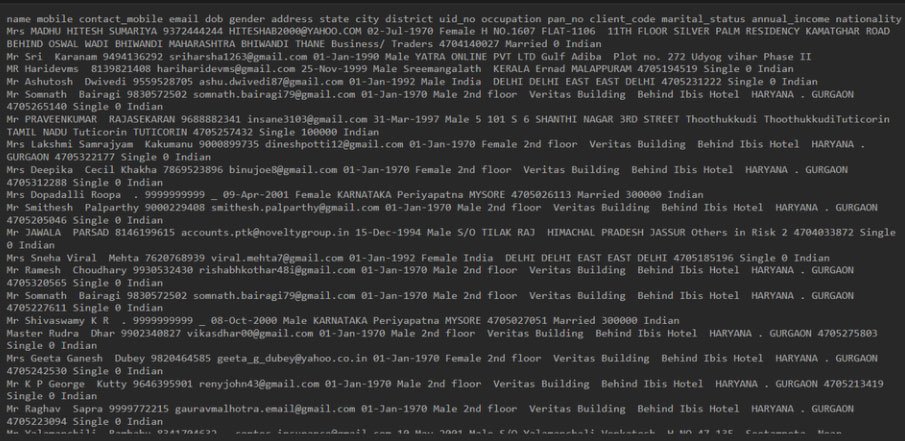

Figure 2:Sample provided by the threat actor

The exposed data set includes detailed personal and financial information which poses a significant threat to the privacy and financial security of the affected individuals.

Specific Data Compromised:

- Personal Identifiable Information (PII): Full names, mobile numbers, email addresses, dates of birth, and gender.

Contact Details: Residential addresses, state, city, and district information. - Sensitive Financial Details: UID numbers, PAN numbers, client codes, marital status, annual income, and occupational details.

- Nationality Information: Details that specify the nationality of each individual.

Verification of Data Authenticity:

Several samples provided by the threat actor were verified using a mobile number lookup tool, confirming their authenticity. This validation points to the severity of the data breach and the legitimacy of the claimed exposure.

Implications of the Exposed Data:

- Financial Fraud and Identity Theft: The availability of PAN numbers and other personal identifiers can lead to financial fraud. Criminals can potentially create fake identities or execute fraudulent transactions.

- Privacy and Security Risks: The breach could result in severe privacy violations due to the exposure of personal and financial details. Individuals may face unwanted contact or harassment.

- Targeted Phishing Attacks: With detailed personal information, affected individuals are at high risk of targeted phishing and scamming attempts. Attackers could use the detailed information to craft convincing messages to deceive victims.

Risk Management Recommendations:

- Immediate Incident Response: Liberty General Insurance should act swiftly to mitigate the breach’s impact. This includes informing affected customers and providing them with fraud alerts and credit monitoring services.

- Enhanced Security Posture: It is critical to review and enhance cybersecurity measures. This should include the implementation of stronger data encryption, regular security audits, and updated access controls.

- Customer Awareness and Education: Liberty General Insurance should educate their customers about potential phishing threats and security best practices to protect their personal and financial information.

CONCLUSION

This data breach represents a critical security event that impacts not only the privacy of thousands of individuals but also poses broader financial risks. It is imperative for Liberty General Insurance to address this breach with urgency and thoroughness to protect its customers and restore trust.